Latest from the Fraud Office

Published: 06 October 2021

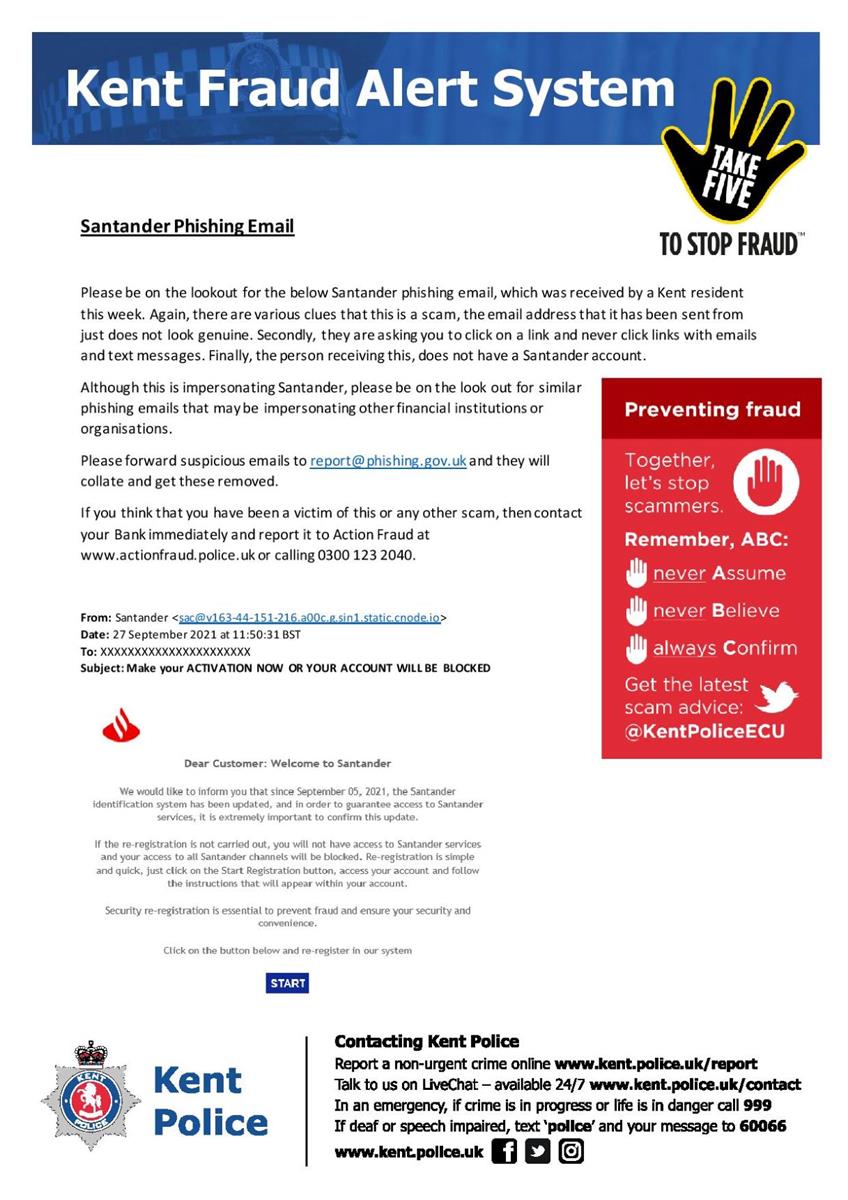

Santander Phishing Email

Please be on the lookout for the below Santander phishing email, which was received by a Kent resident this week. Again, there are various clues that this is a scam, the email address that it has been sent from just does not look genuine. Secondly, they are asking you to click on a link and never click links with emails and text messages. Finally, the person receiving this, does not have a Santander account.

Although this is impersonating Santander, please be on the look out for similar phishing emails that may be impersonating other financial institutions or organisations.

Please forward suspicious emails to report@phishing.gov.uk and they will collate and get these removed.

If you think that you have been a victim of this or any other scam, then contact your Bank immediately and report it to Action Fraud at www.actionfraud.police.uk or calling 0300 123 2040.

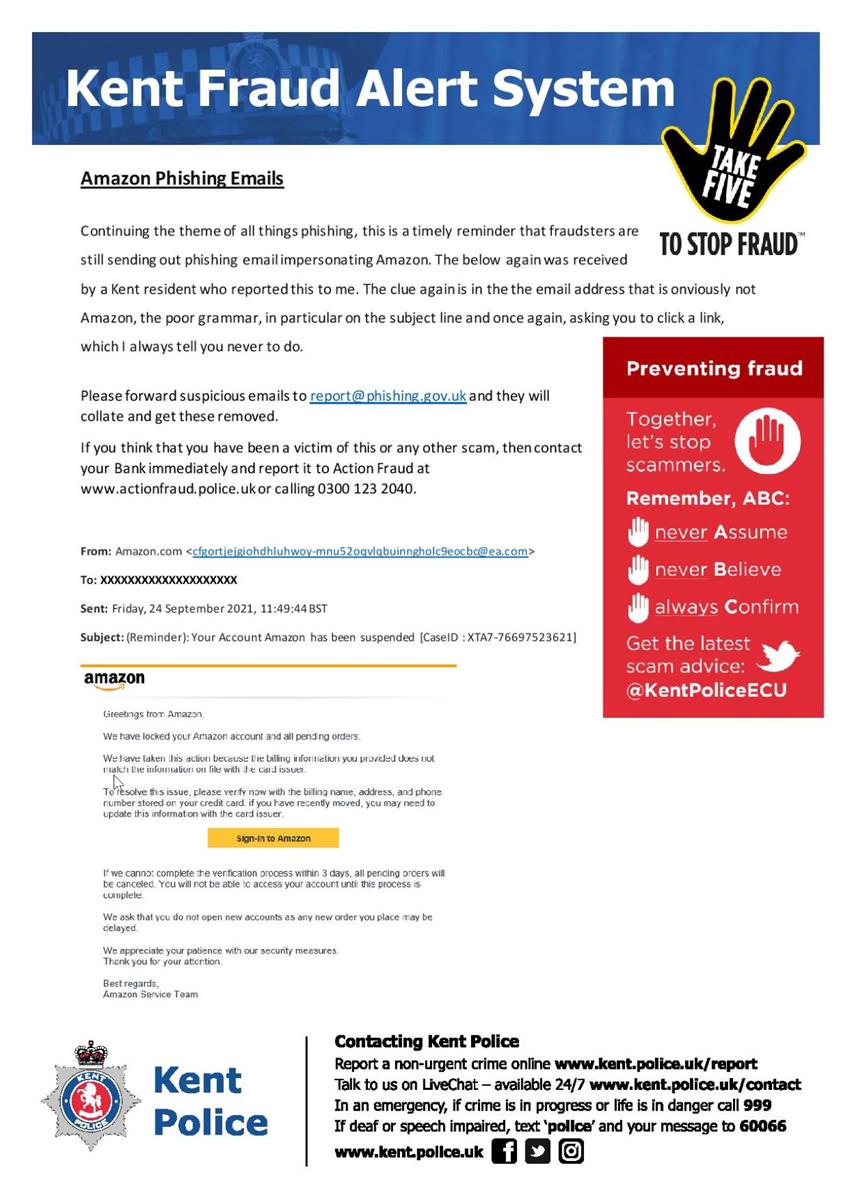

Amazon Phishing Emails

Continuing the theme of all things phishing, this is a timely reminder that fraudsters are still sending out phishing email impersonating Amazon. The below again was received by a Kent resident who reported this to me. The clue again is in the the email address that is obviously not Amazon, the poor grammar, in particular on the subject line and once again, asking you to click a link, which I always tell you never to do.

Please forward suspicious emails to report@phishing.gov.uk and they will collate and get these removed.

If you think that you have been a victim of this or any other scam, then contact your Bank immediately and report it to Action Fraud at

www.actionfraud.police.uk or calling 0300 123 2040.

New Fraud Hotline - 159

A new emergency hotline has been launched for people to report and check financial scams as they happen. A potential victim who dials 159 will be automatically connected to their bank's fraud prevention service.

Anyone who receives a call or message from somebody claiming to be from a trusted organisation and who suggests money should be transferred is being urged to hang up and call 159.

The new service is being promoted by Stop Scams UK - a coalition of banking and technology companies. Initially, the project is being run for a year, but the intention is for it to become a universal service eventually. However, not all banks and building societies are signed up. TSB will not join until January.

Banks that are taking part include Barclays, Lloyds (including Halifax and Bank of Scotland), NatWest (including Royal Bank of Scotland and Ulster Bank), Santander and Starling Bank.

Nationwide Building Society said it would join but it also launched its own version on Monday. More than 80% of UK mobiles and landlines will be able to use 159 at the outset, costing the same as a national rate call.